Record information as you receive it

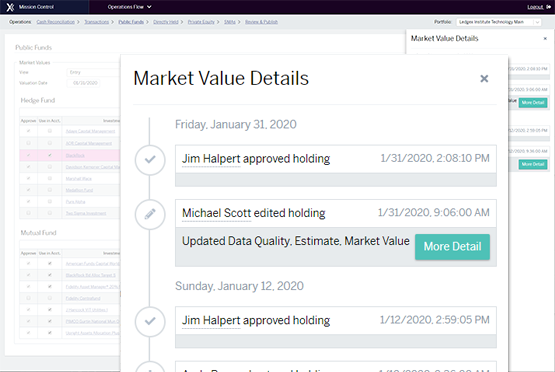

Last weeks estimate will be replaced by a cap statement and then corrected for a transposed digit.

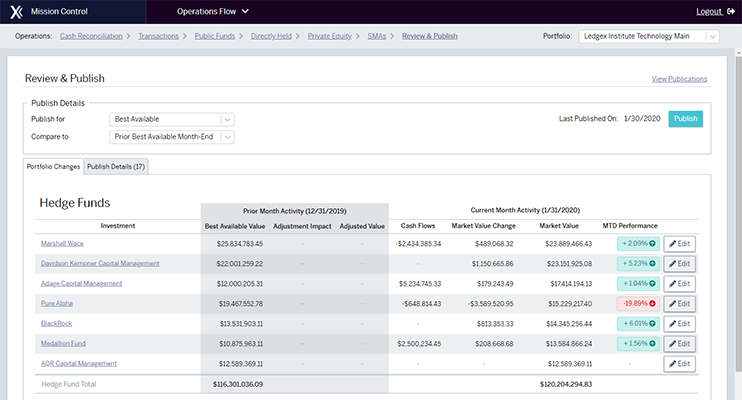

Record it all as it happens, Mission Control stages your data and tracks the history. Publish “best available” data as frequently as your investment team wants for performance, select an accounting value to close your books, and continue to add detail and updates as more information arrives.

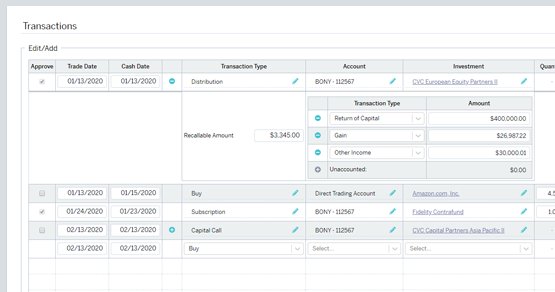

Comprehensive Transaction Support

Built-in support for transactions ranging from Hedge Fund Subscriptions and Redemptions to Cash Transactions to Buy, Sell, Short, and Cover for Marketable Securities.

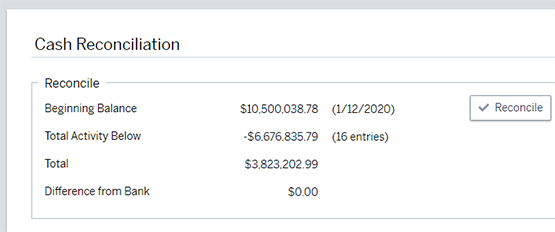

Daily Cash Reconciliation to Financial Institution

Reconcile cash accounts on a daily, weekly, or monthly basis. Expected transactions are added automatically, with visibility into future projected activity for the account.

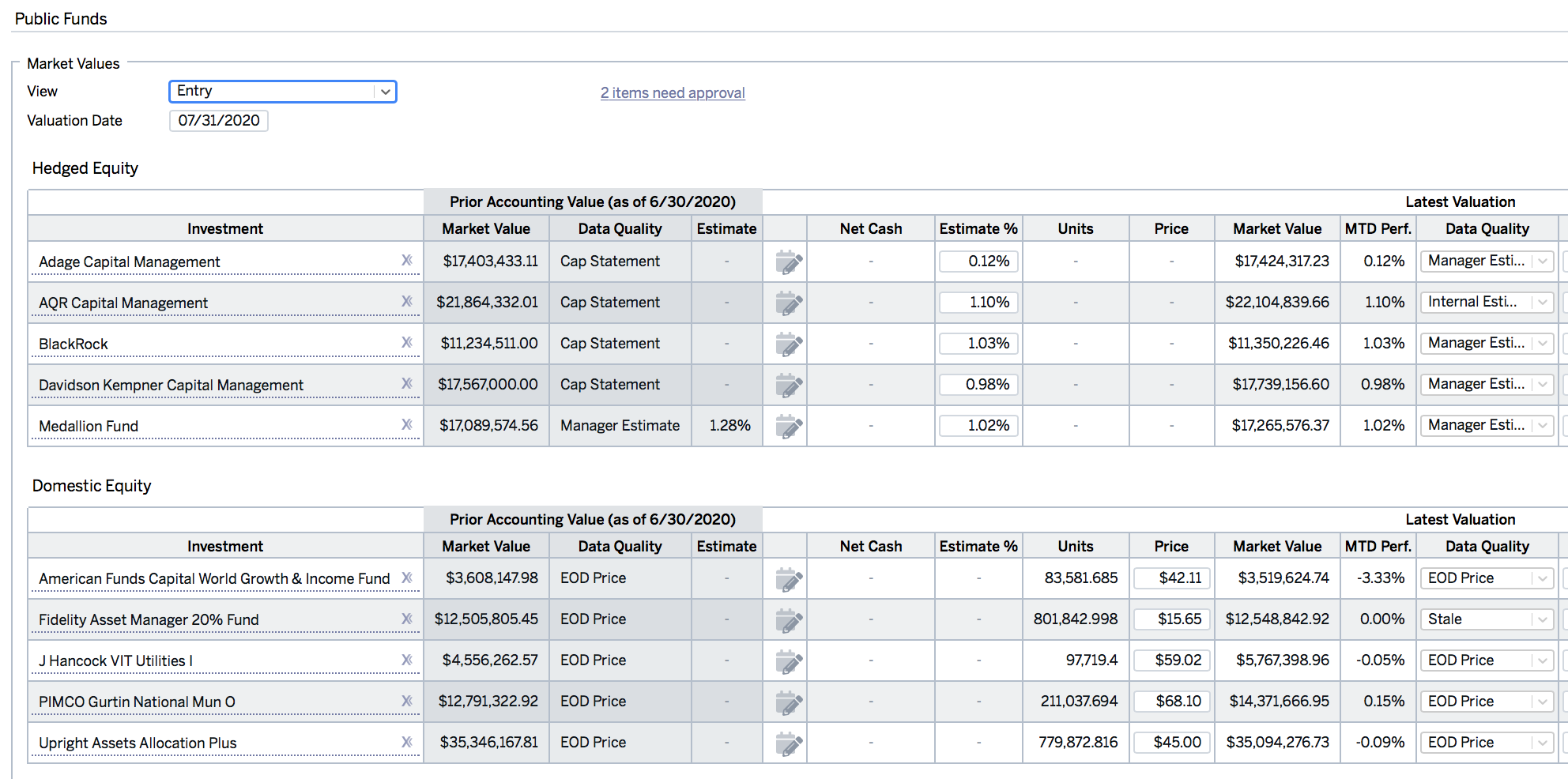

Market Value Tracking

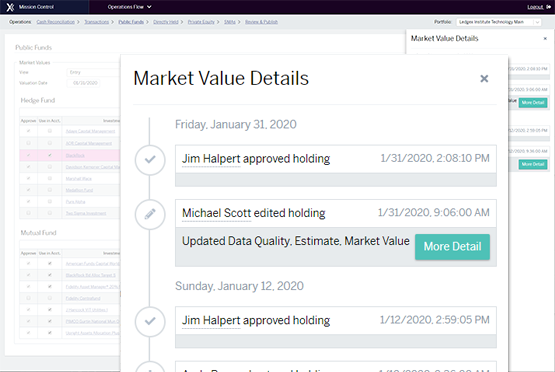

Enter values for unitized and non-unitized funds as you receive them. Track the data source and quality, purpose of every edit, and whether the values can be used for accounting. Enter estimates and updated cap statements, see cashflow impact, and more.

Full Audit Trail

Full audit tracking. With one click, you can see every revision as better information became available, each manual correction or override, and each approval, with full time and user detail.

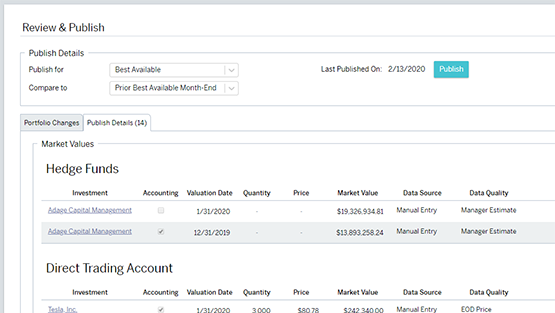

Data Staging Area

Collect transactions and market values and publish data independently for accounting and performance. Publish as frequently as you want, whether that’s daily for performance flash reports on best available data, weekly for accounting, or even a three day hold to accounting that doesn’t delay performance data.

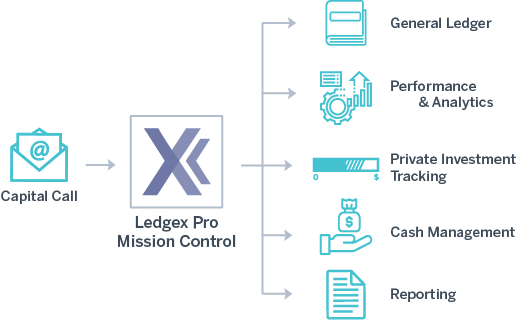

Full Suite Integration

Mission Control is designed to provide a better data quality foundation for your office. Combine it with our General Ledger, Performance & Analytics, or Private Investment Tracking modules, and take advantage of seamless integration of staged transaction data, Investments, Legal Entities, and more.

Let's start the office with better quality, pre-reconciled data, every day.

Ledgex enables offices like yours to more confidently and successfully manage complex portfolios, with game-changing improvements in your data accuracy, transparency, and timeliness.